Thursday, September 9, 2010

Commodity prices continue to rise

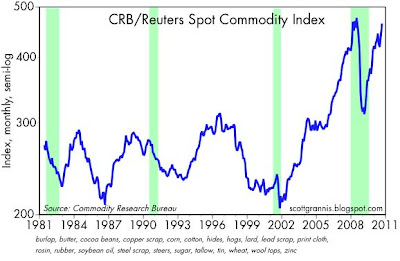

Industrial spot commodities (this chart shows the CRB Spot Commodity Index) are on a tear, having risen over 10% since July. Where there's this much commodity smoke, there is likely an economy (or easy money) that is on fire. A long-term chart of the same index follows. Note the composition of the index—it contains no energy, consists mostly of mundane things that are part of basic industrial processes, and very few have associated futures contracts. This is a very down-to-earth collection of commodities. At the very least the commodity action is a strong vote against the existence of a double-dip recession, and a very strong vote against the risk of deflation. Most likely, it reflects both an ongoing global recovery and easy money. Easy money creates extra demand for commodities, since tangible assets in general are natural hedges against the risk that paper money loses its value.

Subscribe to:

Post Comments (Atom)

3 comments:

are the buyers hiding the commodities with no futures market under their mattrresses. this is lame analysis.

HYG, the high yield ETF traded at a high for the year today. These people are investing real money and they are not seeing a contracting economy near term.

Commodities are being bought by companies who have ORDERS for their output. It is hardly 'lame analysis'.

BTW, words beginning a sentence are capitalized and questions are punctuated with a question mark, not periods.

I made the same mistakes when I was in high school.

Septi,

Grammatical errors are a pet peeve of mine. I mean no personal disrespect to you. Please do not take it as such.

Just sayin'.

Post a Comment