Ever since late 2008 I have been making the point that whatever is wrong with the economy, it's not a shortage of money that is problem. That remains the case today. There are no signs that money is in short supply, either nominally or relative to the demand for money. Therefore there is no reason to worry about deflation or a deflation-induced slump in demand.

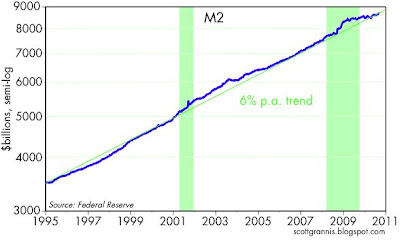

The best measure of money is M2, because it's definition hasn't changed much over time and for decades it has had a relatively stable relationship to GDP. I think most economists would agree on this. The first chart above shows the level of M2 over the past 16 years. As should be evident, M2 has grown on average about 6% a year. Sometimes faster, sometimes slower, but it always seems to revert to something like 6% a year, which also happens to be very close to the annualized growth rate of nominal GDP over the past 20 years or so. The slower growth of M2 in the past year or so is simply "payback" for very rapid growth in 2008, when a surge in money demand pushed up all monetary aggregates.

It was therefore not a coincidence that the the peak in M2 growth coincided almost exactly with the bottom of the stock market (March 2009). That was a big turning point, because what occurred was a rise in confidence accompanied by a decline in the demand for money. Money velocity picked up as people started spending the money they had hoarded, and that process continues to this day.

Meanwhile, the Fed force-fed $1 trillion to the banking system, swelling the monetary base and bank reserves by an unimaginable amount. Most of the extra reserves are still sitting idle at the Fed, though, since the world's demand for dollars remains elevated. (When demand for money is high, the demand for loans is weak. That's another way of saying that the world is still trying to deleverage, so demand for bank loans is not very strong.)

The recent increase in the M2 growth rate (M2 is up at 4.6% annualized rate in the past three months reflects a bit of an increase in money demand over that period, and that is likely a reflection of the confidence shock that resulted from concerns over the possible collapse of the european banking system. It is also the case that renewed concern over the health of the economy helped drive yields lower, and that in turn resulted in a surge of refinancing activity, which in turn has a strong tendency to increase money in circulation temporarily.

In short, I see nothing in the money numbers that is strange or foreboding—except, of course for the massive amount of bank reserves that lie in waiting to accommodate renewed loan demand. They haven't presented a problem so far, but at some point they could result in a significant expansion of bank lending which in turn could feed the fires of inflation if the Fed doesn't react in a timely fashion to drain those reserves. That's been a big worry for a long time, but so far nothing untoward has happened.

8 comments:

Well, the old saw is some see the glass half-full and others half-empty.

I do not worry about inflation; on the contrary, we may be in deflation already if Milton Friedman and Michael Boskin are right about CPI measurements. The trend lines on core CPI are plunging towards zero or lower.

The trillion or so in quantitative easing? If the money supply is causing inflation, we have yet to see the slightest hint of it, or expectations of it. Bond buyers flood TS treasuries auctions with money at low, low rates. I suspect rates go lower.

Friedman said low interest rates are a sign of tight money.

On money supply or monetary expansionism: It is not too expansionary if the economy is feeble and inflation slumping to deflation. That describes us today. It is relative.

You might pump huge amounts of air into a tire---it doesn't matter how much you pump, what matters is if the tire is inflated. We gotta pump some more.

One wacko idea I have is that the Fed and the Bank of Japan are going to have to learn how to master QE.

If zero bound becomes a frequent guest (it has moved in and taken over the master bedroom in Japan), then we have to devise other non-fiscal ways to stimulate. Ergo, QE.

QE may become the monetary choice of the future.

There is never a shortage of money in a fiat currency system. The simple answer to those in-charge is to always print more of it.

Ironically, nobody can prove that an economy needs additional money equivalent to the pace of GDP, but as you rightfully point out, it continues to grow unabated at or around that pace.

Eventually all of this money printing will come home to roost.

Public: In theory, according to Milton Friedman the job of a central bank should be to allow the money stock to grow by the amount of real growth in the economy plus the desired amount of inflation. By that standard, the Fed has been doing a perfect job.

The problem with Friedman's prescription, however, was that the velocity of money can and does change, so a strict money growth rule might prove disruptive to the economy.

In any event, it is hard to believe that 6% money growth and 6% nominal GDP growth are a prescription for a big rise in inflation. Especially since those numbers have been the norm for the past 25 years without any major acceleration in inflation.

Scott,

Did excess leverage cause stocks to reach their highs in 2007? If so, then would it not take quite some time for stocks to recover to those levels given the de-leveraging trend?

scott sumner says you are flat wrong

Some people believe that the Wizard of OZ lives in the basement of the Fed. He can turn the dials and pull the levers and fix the economy. He just needs the right operating manual. So on Nov 1 when he gets an estimated NGDP, he can fiddle with the controls and put us back on track with a mid-course adjustment when "final" NGDP appears.

Of course we don't know exactly what and how much the wizard should do and we have no reason to think a particular course of action will be stabilizing or destabilizing. Add to this the fact that everyone will be watching on Nov 1 so they can predict what the wizard's going to do next.

For this to be stabilizing people have to believe it will work. If they don't believe then the wizard becomes another source of disruption and uncertainty.

People believe that stable interest rates equate to consistent, predictable monetary policy. This is very important, especially when the administration is so hostile to business.

There is no evidence that monetary policy is delaying the recovery. Commodity prices are rising, the dollar continues to drift down, the yield curve slopes up, M2 is expanding slowly, equities have been trending up for the last 18 months. Buying T-bonds and creating more excess reserves is supposed to make a difference?

Scott:

Sure the banking sector has seen huge inflow of cash, but it has recycled most of it towards the feds.

M2 growth is fascinating, but what about velocity, which is down in the dump.

In effect the banks have been sterilizing the cash

Bill: I don't believe that leverage is capable of doing magic things. The only leverage that is meaningful in a macro sense is banks using reserves to create new money. Since M2 hasn't displayed any unusual growth over the years, I rule out excessive money creation as an explanation. Some people were using too much leverage, and that destroyed them. Many are now trying to deleverage, but that doesn't reduce aggregate demand, it just affects relative asset prices. Leverage can never create demand out of thin air, so deleveraging can't destroy demand.

Post a Comment