Today's first revision to Q2/13 GDP growth (which was revised up from 1.7% to 2.5%) brought with it the first look at corporate profits for the quarter, and the news was excellent. After-tax corporate profits rose to a new all-time of $1.68 trillion, up 7% from a year ago. This is actually within the realm of astonishing if one considers that this measure of profits (arguably the best measure of "true" or economic profits) has increased 218% since the first quarter of 2000 (when the S&P 500 hit its peak for the year), yet the S&P 500 is up only 7.5% since then. With the benefit of hindsight we know that stocks were grievously overvalued in 2000—but that can hardly be the case today.

Note how strong corporate profits have been since 2000, despite the current sluggish recovery (actually the weakest recovery in history).

The chart above provides a long-term perspective on how corporate profits behave relative to nominal GDP.

Relative to nominal GDP, corporate profits today are just shy of an all-time high.

Using the methodology explained in my post last week, the chart above shows the PE ratio of the stock market using the NIPA measure of after-tax corporate profits instead of trailing 12-month earnings. This suggests that stocks currently are trading about 25% below their historical average PE. This is also astonishing since PE ratios tend to track interest rates inversely (i.e., PE ratios tend to be low when market interest rates are high, and vice versa). 10-yr Treasury yields are still extremely low from an historical perspective, yet PE ratios are quite low from the same perspective. This suggests that the market has hardly any confidence in the ability of corporate profits to maintain current levels. Instead, it seems like the market is priced to the expectation that corporate profits will "mean revert" to their long-term average of 6-6.5% of GDP.

But as I've argued before, it is not necessarily the case that corporate profits have to, or are likely to, revert to some historical mean relative to GDP. U.S. corporations are increasingly operating in a rapidly-expanding global economy and marketplace. As the chart above suggests, corporate profits relative to global GDP are still fairly close to their long-term average. Thus there may be little reason to think that profits need to decline significantly or that they are at unsustainably high levels today.

NIPA profits and reported earnings tend to track each other over time, with NIPA profits tending to lead trailing earnings. This suggests that reported earnings are likely to continue to grow.

At the very least, the news on corporate profits provides solid support to the current level of equity valuations. Viewed from an optimistic perspective, stocks would appear to have lots more upside potential and could be considered significantly undervalued.

Thursday, August 29, 2013

Tuesday, August 27, 2013

How scary is Syria?

The Obama administration has been busy preparing the world for a likely and imminent attack (most likely via drones and/or cruise missiles) against Syria in retaliation for Assad's use of chemical weapons on his people. Markets are nervous.

Things could certainly get worse, if, for example, Iran carries out its threat to attack Israel in retaliation for a U.S. attack against Syria. But for now, let's let key market-based indicators tell us how scary the current situation is:

The Vix index of implied equity volatility has jumped to almost 17, its fourth-highest level this year. Earlier this month it sat at a relatively tranquil 12.

But from a multi-year perspective, today's jump barely registers.

Comparing the Vix Index to the 10-yr Treasury yield shows the current threat to be more substantial than just looking at the Vix in isolation. That's because 10-yr Treasury yields are still quite low from an historical perspective—which is symptomatic of a pretty weak economic outlook. Markets are nervous and the economy is weak, so that is more threatening than if the market were equally nervous but the economy were stronger. Still, the current Vix/10-yr ratio pales in comparison to the level registered during other major events in the past two decades.

The chart above shows Bloomberg's calculation of the PE ratio of the S&P 500. It's down today because everyone is nervous, but it's only a bit less than its long-term average of 16.6. That's neither over- nor significantly under-valued.

On balance, it would appear that the market today is saying that while the Syria issue is certainly something to worry about, it is not likely to have much of an impact on the economy.

We'll soon know if the market has correctly estimated the gravity of the Syria situation.

Things could certainly get worse, if, for example, Iran carries out its threat to attack Israel in retaliation for a U.S. attack against Syria. But for now, let's let key market-based indicators tell us how scary the current situation is:

The Vix index of implied equity volatility has jumped to almost 17, its fourth-highest level this year. Earlier this month it sat at a relatively tranquil 12.

But from a multi-year perspective, today's jump barely registers.

Comparing the Vix Index to the 10-yr Treasury yield shows the current threat to be more substantial than just looking at the Vix in isolation. That's because 10-yr Treasury yields are still quite low from an historical perspective—which is symptomatic of a pretty weak economic outlook. Markets are nervous and the economy is weak, so that is more threatening than if the market were equally nervous but the economy were stronger. Still, the current Vix/10-yr ratio pales in comparison to the level registered during other major events in the past two decades.

The chart above shows Bloomberg's calculation of the PE ratio of the S&P 500. It's down today because everyone is nervous, but it's only a bit less than its long-term average of 16.6. That's neither over- nor significantly under-valued.

On balance, it would appear that the market today is saying that while the Syria issue is certainly something to worry about, it is not likely to have much of an impact on the economy.

We'll soon know if the market has correctly estimated the gravity of the Syria situation.

Housing recovery slows down

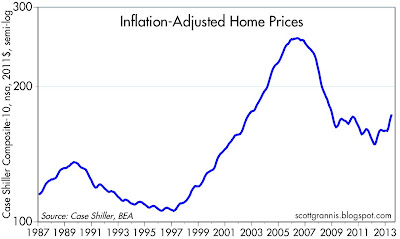

It's nice to see housing prices clearly on the rise, as shown in the chart above. It's about time, considering that housing has suffered through a four-year consolidation after three years of a terrifying decline. Housing starts collapsed, falling by more than 75% from early 2006 through 2009. Dramatically lower prices and an almost-complete halt to new construction were necessary to "fix" the oversupply of homes, and enough time has now passed to think that the process of recovery is finally underway.

But as the chart above shows, the pace of improvement is slowing. The chart shows nonseasonally adjusted prices for 2011 (red), 2012 (orange) and 2013 (white). Prices this year are not following the typical seasonal pattern we've seen in other years—there has been some weakness of late (April and May). This has probably continued, since we know that new mortgage applications have dropped a little over 10% in the past two months, mainly in response to a sharp increase in mortgage rates. It's going to take several months for the market to adjust to the new reality of higher interest rates.

On an inflation-adjusted basis, the recent rise in home prices has been only slightly more than necessary to make up for the past several years' worth of inflation. We're seeing a recovery in nominal prices, but only a modest rise in real prices from the nominal lows of 2009. I doubt we're going to see any actual weakness in the housing market, but the recovery has lost some of its steam, so improvement in the months to come will likely be much less exciting.

Monday, August 26, 2013

20 optimistic charts

I continue to believe that the market is dominated by pessimism rather than optimism. Or, if you will, that there is a shortage of optimism.

What follows are some 20 or so charts, in random order, which highlight optimistic developments in the economy and financial markets which I believe are underappreciated. They paint a picture of an economy that is stronger and more durable than the skeptics seem to believe. There's still plenty of room for improvement, to be sure, but there are few if any signs of deterioration.

Banks have increased their lending to small and medium-sized businesses by almost $400 billion in less than 3 years. This reflects increasing optimism on the part of banks (who are more willing to lend) and on the part of businesses (who are more willing to borrow). There are undoubtedly many businesses that have been unable to obtain loans for worthwhile projects, but their number is definitely declining on the margin. One of the key factors holding the economy back in recent years is a lack of confidence; banks have been reluctant to lend, and businesses have been reluctant to borrow. This is all symptomatic of the deleveraging that has been the national pastime for most of the current recovery but which is slowly fading away.

Consumers have also been working to deleverage, and it shows in the three charts above. Delinquency rates on credit cards and consumer loans in general have fallen to the lowest level in recent history, while credit card loan chargeoff rates have plunged to levels rarely seen in the past. Households' financial burdens (monthly payments as a % of disposable income) have fallen to their lowest level in many decades. Consumers on average are in much better financial health these days than they have been for a long time.

The number of people receiving unemployment insurance has been declining steadily and significantly for over four years. There are 1.15 million fewer people "on the dole" today than there were a year ago, and that's a sizable reduction of over 20%. This is creating healthier incentives in the workforce, since it means many of the unemployed have a stronger incentive today to find and accept a job.

Mortgage rates are up sharply in the past few months, but they are still extraordinarily low from an historical perspective. While this raises the bar for new homebuyers, most are still in good shape to qualify, as the second of the above charts shows. A typical family earning a median income today still has about 66% more income than needed to qualify for a conventional loan for a median-priced house.

The above chart shows Bloomberg's Financial Conditions Index, a composite of a variety of key indicators of financial market health (e.g., implied volatility, general liquidity conditions, credit spreads). This index is now at a new high. Healthy financial markets are necessary for a healthy economy, but not sufficient, of course. We are still lacking in the confidence department, and government is still placing excessive regulatory and tax burdens on the economy. That's terribly unfortunate, but having healthy financial fundamentals does mean that the right combination of growth-oriented policies could unleash a new wave of economic growth.

Several months ago, I noted that one of the biggest changes on the margin was the rise in real yields. That's still the case today, and the above three charts help explain why. The big rise in real yields has tracked closely with the decline in gold prices (see the first of the three charts above), and that tells me that the market's appetite for "safe assets" has declined. Gold is the classic refuge from geopolitical and monetary uncertainty, and its decline tells us that the world is worried less about the possibility of a Fed-induced hyperinflation. The measure of the decline in real yields I've used is 5-yr TIPS, because they are another type of "safe asset": default-free, relatively short-term in nature, and immune to inflation. Rising real yields are the flip side of declining demand for TIPS. A decline in the demand for safe assets mirrors an increase in the world's confidence, and that bodes well for future growth.

As the second chart above shows, real yields have a strong tendency to inversely track the earnings yield on stocks. Very low real yields and very high earnings yields are symptomatic of a market that is deeply pessimistic about the prospects for economic growth and corporate profits. The recent reversal thus marks a key improvement in the market's outlook for the future.

The third chart above shows how real yields tend to track the economy's growth rate. Very high real yields are typically found at times when economic growth is very strong, and low real yields are symptomatic of weak growth. The recent rise in real yields means the market is now somewhat less pessimistic about the future.

The world still agonizes over U.S. budget deficits, but the above charts document the huge improvement there has been in the just the past few years on this front. Most of the improvement has come from stable and even declining levels of federal spending, since that shrinks the burden of government and gives the private sector more breathing room. Strong growth in revenues has also contributed, but that is more symptomatic of an improving economy (e.g., more jobs, higher incomes, higher profits) than it is of higher tax rates. It all adds up to a huge reduction in the burden of the deficit, from a high of over 10% of GDP to the current level of just over 4%. This is very positive for the future, since it dramatically reduces the likelihood of the need for higher tax rates and even opens up the possibility of tax rate reductions.

Swap spreads are critically important and sensitive indicators of systemic risk. Currently below 20 bps, they signal very healthy financial market conditions and an almost complete absence of systemic risk.

Architectural billings have been increasing for most of the past year, a clear sign that the economy has recovered enough confidence to once again begin major construction projects. The improvement here is still in its infancy, however, but that does nothing to take away from the importance of this development.

Mortgage rates typically follow the yield on 10-yr Treasuries. The spread between the two averages about 80-100 bps, and that's pretty close to where we are today. Mortgage rates have jumped along with Treasury yields, but both are still very low from an historical perspective. The recent rise in rates is very unlikely to snuff out economic growth; it's much more likely to be symptomatic of the economy's improving (though still relatively weak) economic growth fundamentals. Interest rates tend to be driven by economic activity, not the other way around. Three cheers for higher rates!

Since late last year, Japan's monetary policymakers have been making a concerted effort to reverse the deflationary forces that have plagued its economy for decades. This shows up first in a substantial devaluation of the yen. That this is a positive development shows up in the sustained rise in equity prices which has accompanied a weaker yen. What's good for Japan is going to be good for the whole world.

Thanks to new fracking technology, U.S. production of natural gas has soared and the price of natural gas has plunged, both in nominal terms and relative to the cost of oil. Since natural gas is not readily exportable, this has given energy-intensive U.S. industry a key low-cost advantage relative to overseas producers that is likely to endure for at least the next few years.

Contrary to what so many bears seem to believe, I think these charts provide convincing evidence of an economy that is gradually improving. There is nothing fictitious about the data here, and most of the charts use market-based data that is not subject to revision or faulty seasonal adjustment factors. This is real.

What follows are some 20 or so charts, in random order, which highlight optimistic developments in the economy and financial markets which I believe are underappreciated. They paint a picture of an economy that is stronger and more durable than the skeptics seem to believe. There's still plenty of room for improvement, to be sure, but there are few if any signs of deterioration.

Banks have increased their lending to small and medium-sized businesses by almost $400 billion in less than 3 years. This reflects increasing optimism on the part of banks (who are more willing to lend) and on the part of businesses (who are more willing to borrow). There are undoubtedly many businesses that have been unable to obtain loans for worthwhile projects, but their number is definitely declining on the margin. One of the key factors holding the economy back in recent years is a lack of confidence; banks have been reluctant to lend, and businesses have been reluctant to borrow. This is all symptomatic of the deleveraging that has been the national pastime for most of the current recovery but which is slowly fading away.

Consumers have also been working to deleverage, and it shows in the three charts above. Delinquency rates on credit cards and consumer loans in general have fallen to the lowest level in recent history, while credit card loan chargeoff rates have plunged to levels rarely seen in the past. Households' financial burdens (monthly payments as a % of disposable income) have fallen to their lowest level in many decades. Consumers on average are in much better financial health these days than they have been for a long time.

Credit spreads are excellent indicators of the health of corporate balance sheets and cash flow. Spreads today are very near their post-recession lows, which marks significant progress from the terrifying heights of the past recession. But spreads are still substantially higher than they have been at their previous lows. We've made great progress, but there is still room for improvement. It's worth noting that even with the current scare over the approaching "tapering" of QE, credit markets reflect absolutely no increase in systemic risk. Investors and analysts may be spooked by tapering, but the bond market is behaving as though it is going to be a non-event.

The number of people receiving unemployment insurance has been declining steadily and significantly for over four years. There are 1.15 million fewer people "on the dole" today than there were a year ago, and that's a sizable reduction of over 20%. This is creating healthier incentives in the workforce, since it means many of the unemployed have a stronger incentive today to find and accept a job.

Mortgage rates are up sharply in the past few months, but they are still extraordinarily low from an historical perspective. While this raises the bar for new homebuyers, most are still in good shape to qualify, as the second of the above charts shows. A typical family earning a median income today still has about 66% more income than needed to qualify for a conventional loan for a median-priced house.

The above chart shows Bloomberg's Financial Conditions Index, a composite of a variety of key indicators of financial market health (e.g., implied volatility, general liquidity conditions, credit spreads). This index is now at a new high. Healthy financial markets are necessary for a healthy economy, but not sufficient, of course. We are still lacking in the confidence department, and government is still placing excessive regulatory and tax burdens on the economy. That's terribly unfortunate, but having healthy financial fundamentals does mean that the right combination of growth-oriented policies could unleash a new wave of economic growth.

Several months ago, I noted that one of the biggest changes on the margin was the rise in real yields. That's still the case today, and the above three charts help explain why. The big rise in real yields has tracked closely with the decline in gold prices (see the first of the three charts above), and that tells me that the market's appetite for "safe assets" has declined. Gold is the classic refuge from geopolitical and monetary uncertainty, and its decline tells us that the world is worried less about the possibility of a Fed-induced hyperinflation. The measure of the decline in real yields I've used is 5-yr TIPS, because they are another type of "safe asset": default-free, relatively short-term in nature, and immune to inflation. Rising real yields are the flip side of declining demand for TIPS. A decline in the demand for safe assets mirrors an increase in the world's confidence, and that bodes well for future growth.

As the second chart above shows, real yields have a strong tendency to inversely track the earnings yield on stocks. Very low real yields and very high earnings yields are symptomatic of a market that is deeply pessimistic about the prospects for economic growth and corporate profits. The recent reversal thus marks a key improvement in the market's outlook for the future.

The third chart above shows how real yields tend to track the economy's growth rate. Very high real yields are typically found at times when economic growth is very strong, and low real yields are symptomatic of weak growth. The recent rise in real yields means the market is now somewhat less pessimistic about the future.

The world still agonizes over U.S. budget deficits, but the above charts document the huge improvement there has been in the just the past few years on this front. Most of the improvement has come from stable and even declining levels of federal spending, since that shrinks the burden of government and gives the private sector more breathing room. Strong growth in revenues has also contributed, but that is more symptomatic of an improving economy (e.g., more jobs, higher incomes, higher profits) than it is of higher tax rates. It all adds up to a huge reduction in the burden of the deficit, from a high of over 10% of GDP to the current level of just over 4%. This is very positive for the future, since it dramatically reduces the likelihood of the need for higher tax rates and even opens up the possibility of tax rate reductions.

Swap spreads are critically important and sensitive indicators of systemic risk. Currently below 20 bps, they signal very healthy financial market conditions and an almost complete absence of systemic risk.

Architectural billings have been increasing for most of the past year, a clear sign that the economy has recovered enough confidence to once again begin major construction projects. The improvement here is still in its infancy, however, but that does nothing to take away from the importance of this development.

Mortgage rates typically follow the yield on 10-yr Treasuries. The spread between the two averages about 80-100 bps, and that's pretty close to where we are today. Mortgage rates have jumped along with Treasury yields, but both are still very low from an historical perspective. The recent rise in rates is very unlikely to snuff out economic growth; it's much more likely to be symptomatic of the economy's improving (though still relatively weak) economic growth fundamentals. Interest rates tend to be driven by economic activity, not the other way around. Three cheers for higher rates!

Since late last year, Japan's monetary policymakers have been making a concerted effort to reverse the deflationary forces that have plagued its economy for decades. This shows up first in a substantial devaluation of the yen. That this is a positive development shows up in the sustained rise in equity prices which has accompanied a weaker yen. What's good for Japan is going to be good for the whole world.

Contrary to what so many bears seem to believe, I think these charts provide convincing evidence of an economy that is gradually improving. There is nothing fictitious about the data here, and most of the charts use market-based data that is not subject to revision or faulty seasonal adjustment factors. This is real.

Stocks are up because the economy continues to expand

Capital goods orders are notoriously volatile from month to month, so I have long preferred to look at a 3-month moving average of the series, which is shown in the chart above. July orders for this proxy for business investment fell 3.3% from June, but the 3-mo. moving average is at a new all-time high and is up at a 8.8% annualized rate over the past six months.

The much-broader category of factory orders has also been notching new highs, up almost 8% in the year ending June. To the extent factory orders are a good proxy for the physical side of the economy, it validates the performance of the equity market—stocks are rising because the economy is expanding.

The amount of freight hauled around by the U.S. trucking industry is another proxy of sorts for the size of the physical economy. As the chart above shows, truck tonnage also validates the recent rise of the equity market, shown here in real terms. Note how both this and the preceding chart show that equity valuations were way out of line (i.e., too high) compared to the expansion of the economy in the the late 1990s and early 2000s. Not so today: no sign here of "irrational exuberance." The market is up because the economy is expanding.

Tuesday, August 20, 2013

Equity valuation exercises

Equity valuation is more art than science, since there are methods which produce a variety of results (e.g., stocks today are variously considered either very expensive, fairly valued, or very cheap), and no measure can claim to be an infallible method of predicting future returns. So with those caveats, what follows are some of my own methods and how they contrast to other popular methods.

To start the discussion, you should read Jeremy Siegel's article that appeared in yesterday's FT: "Don't put faith in Cape crusaders."One of his points is that the now-famous Shiller PE ratio, which shows stocks to be relatively expensive today, might be overstating the valuation of stocks because it understates the value of earnings. He notes, for example, that accounting standards changed in the 1990s, and that had the effect of depressing reported earnings relative to the measure of corporate profits that comes from the NIPA (GDP) statistics, and making them more volatile. I illustrate that in the above chart, which directly compares NIPA profits to S&P 500 reported earnings (note that the y-axis of both series covers a similar span, with the top value being 100 times the bottom value). NIPA profits are clearly much less volatile, and the two series indeed began to diverge in the early 1990s. This backs up Siegel's assertion that Shiller's method could be improved by using NIPA profits instead of reported earnings.

John Authers argues in another recent FT piece, "From CAPE to CAPE," that reported earnings also suffer from changing taxation regimes, and he shows Alain Bokobsa's adjusted version of the Shiller PE data, which suggests that stocks today are about fairly valued.

I've long been intrigued by the Shiller PE measure, which reportedly divides the S&P 500 index by a 10-yr moving average of inflation-adjusted earnings. But either I'm obtuse, excel-challenged, or possessed of the wrong data, but for the life of me I can't come close to reproducing Shiller's PE ratios if I use inflation-adjusted earnings. (UPDATE: Thanks to reader "Jason" I've looked at Shiller's data and discovered that he adjusts both the index and the earnings—no wonder I couldn't replicate his numbers. However, I also discovered that the recent earnings he is using are about 15% below the earnings as reported by Bloomberg. That has the effect of giving his PE10 an upward bias.) Be that as it may, here are some interesting charts that use various different ways of calculating PE ratios as suggested by Siegel:

The chart above is the classic measure of PE ratios, comparing the S&P 500 index to trailing 12-month earnings, using Bloomberg's measure of adjusted earnings. This shows that stocks today are trading very close to their long-term average PE ratio, suggesting they are fairly valued.

This next chart uses a modified form of the Shiller method: dividing the S&P 500 index by a simple 10-yr moving average of earnings with no inflation adjustment. It's normalized so that the average PE ratio is similar to that shown in the preceding chart. The conclusion is about the same: stocks are fairly valued relative to their long-term average. Using a 10-yr trailing average of earnings does indeed, as Shiller argues, reduce the volatility of PE ratios. Both this chart and the preceding one show stocks to be extremely cheap in the early 1980s, extremely overvalued in 2000, and fairly valued today.

The chart above uses Jeremy Siegel's suggestion that NIPA profits are better than reported earnings because they don't suffer from different accounting standards and because they are less volatile. Instead of dividing the S&P 500 index by a 12-month trailing measure of reported earnings, I've used the NIPA measure of after-tax corporate profits, and I've normalized the data so that the average PE is again about 16. This also shows stocks to be very cheap in the early 1980s and very expensive in 2000, but it suggests that stocks today are very cheap.

This last chart uses a 10-yr moving average of NIPA profits in a manner similar to Shiller's method. Again, the data are normalized so that the long-term average is about 16. This technique produces results that are almost identical to the previous chart, though the PEs are less volatile as might be expected.

Take your pick: according to these valuation exercises, stocks are either very cheap or about fairly valued.

I like the NIPA measure of profits, for the reasons cited above, and because NIPA profits have been calculated using actual data supplied by companies to the IRS and the same methodology throughout (this eliminates arbitrary writeoffs and adjusts for inventory valuation and capital consumption). It's arguably the best measure of true "economic" corporate profits.

So I'm inclined to view stocks as being very attractive today.

Monday, August 19, 2013

Three cheers for higher yields

10-yr Treasury yields are up 130 bps from their all-time lows, and that's absolutely great news. Yields are not up because the market is worried about a tapering of Quantitative Easing. Yields are up because both the market and the Fed realize that the economic fundamentals are improving. Remember how 10-yr yields soared from late 2009 through early 2010, despite the Fed's first round of QE? That wasn't the death of the economy, that was the signal that the economy had recovered. Higher yields naturally accompany stronger growth. If the economy really does pick up some speed, 10-yr yields are likely to move even higher, probably to 3.5% or even 4%.

The rise in real yields is the key, since they tend to track the underlying growth potential of the economy. Real yields are up and gold is down, and those moves point to a stronger economy with less uncertainty. They both reflect a decline in the world's demand for safe assets, and that is happening because uncertainty is declining. With confidence beginning to return, we should see stronger economic growth emerge over the next year or two.

Thursday, August 15, 2013

Industrial production slows in the US, picks up in Europe

U.S. industrial production was a bit disappointing in July, and from the chart above we can see that production growth has been slowing for the past few months. But that slowing is more than offset, from a global perspective, by a surge in German industrial production and some gradual improvement in Eurozone industrial production. The Eurozone appears to be coming out of its 2-year recession, and that is good news for Europeans and for the world.

Claims continue to fall, but the market continues to worry for naught

Weekly claims for unemployment continue to fall, now reaching a new post-recession low of 320K, which by the way was less than the expected 335K (the chart above shows the 4-week moving average).

Can there be any doubt that the economic fundamentals continue to improve? That there is no sign of recession or incipient economic weakness? After more than four years of improvement, it's amazing to me that there can still be so many who moan and groan about how this recovery is so awful. Yes, we should and could have had a lot more people working now, but that doesn't negate the fact that things have been improving relentlessly for over four years.

Claims are rapidly approaching the lowest level that we have ever seen relative to the size of the workforce. What's not to like? Oh, yeah: recessions almost always follow low levels of claims. But it might be years still before another recession hits. Every recession in my lifetime has been the by-product of a tightening of monetary policy. The market is in fits these days not because the Fed is tightening, but because the Fed is nearing the point at which it will begin to ease less. Tapering—buying fewer bonds each month—is still accommodative policy, it's just policy that on the margin is becoming less accommodative.

We are still years away from the time when monetary policy will become tight—as defined by real short-term rates that approach 3-4%, and a yield curve that becomes flat or inverted. The above chart makes it clear that the economy faces absolutely no threat from monetary policy at this juncture.

Tracking the demand for safe assets

Caution, risk aversion, and a lack of confidence have characterized much of the current recovery. So it is not surprising that the demand for money and safe assets has been strong, just as the public's desire to deleverage has been strong (deleveraging is equivalent to wanting more money and less debt). Savings deposits, despite their near-zero yield, have grown at double-digit rates since 2008. T-bill yields are virtually zero, a sign of extremely strong demand for safe assets. The real yields on TIPS plunged deep into negative territory, as the demand for these default-free and inflation-immune assets proved so strong that investors were willing to accept a guaranteed negative real rate of return. Bond mutual funds have enjoyed exceptionally strong inflows for most of the past four years, while equity mutual funds have suffered massive withdrawals. Household financial asset burdens have declined significantly as households have deleveraged. Gold, the preferred asset for those seeking refuge from inflation, geopolitical risk, and the just-plain-jitters, rose to extraordinary heights over more than a decade, doubtless fueled in part by speculators with access to money at historically low interest rates.

Despite the persistence of doubts and fears, the economy and the financial markets have staged a "reluctant recovery," as I described last November.

The latest source of fear is the approaching tapering and eventual reversal of the Fed's Quantitative Easing. Those who believe that QE has been the essential fuel for our (tepid) recovery and the stock market's rather spectacular gains over the past 4+ years worry that the absence of Fed purchases, followed—at some uncertain point in the future—by the reversal of QE (i.e., the sale by the Fed of the trillions of bonds and MBS it now owns) will surely doom this economy. They reason that the Fed's bond purchases have artificially depressed interest rates, and that this in turn has helped boost the economy—so therefore a reversal of QE will depress the economy.

But as I pointed out in a recent post, "the real point of QE was not to lower bond yields, but to create bank reserves for a world that desperately wanted them." For most of the past four or five years, the world's demand for safe assets has been so strong that there was a relative scarcity of traditional vehicles (the primary one being T-bills). Enter bank reserves, which, thanks to the Fed's decision in 2008 to pay interest on reserves, became functionally equivalent to T-bills, but with a superior yield. In just under five years, banks have accumulated almost $2 trillion of "excess" bank reserves, above and beyond the level required to collateralize their deposits. No one has forced them to accumulate these reserves, and no one has forbade them from using those reserves to massively expand their lending. Yet that is what has happened: the accumulation of reserves for no purpose other than to accumulate safe assets with a positive yield. Clearly, there has been intense demand for bank reserves on the part of banks, arguably because they were functionally equivalent to T-bills, the ultimate safe asset, and because banks were not willing to greatly expand their lending activities—just as the private sector has also been working hard to reduce its debt burdens.

To make a long story short, the Fed's massive QE efforts boil down to a simple transmogrification of Treasury notes, Treasury bonds, and MBS into bank reserves, an exercise that proved necessary to accommodate the world's strong and rising demand for safe assets.

It follows therefore that the "tapering" and the eventual unwinding of QE will be necessary to compensate for the declining demand for safe assets, and not a threat to the financial system. The Fed will stop buying and eventually—in a year or so—start selling bonds as the economic fundamentals improve. When they finally do begin to reverse QE, they will be selling bonds at higher interest rates than we have today (e.g., 10-yr Treasury yields of 4% or so) when the demand for them will be stronger. Indeed, if the Fed does not reduce the supply of bank reserves as the demand for them declines, they will risk igniting what could prove to be a very uncomfortable rise in inflation. That is the risk to worry about—that the Fed fails to reverse to QE in a timely fashion—not the reversal of QE.

The tide of risk-aversion seems to be turning. I have argued before that this process, which includes the return of confidence (lack of confidence breeds demand for safe assets, so the return of confidence should go hand in hand with a decline in the demand for safe assets), is already underway, though still in its early stages.

Confidence, though still relatively low, is rising. Savings deposit inflows, though still heady, are slowing. The price of uncertainty has declined to near-normal levels. Real yields, though still low, have jumped. Gold, still quite expensive, has suffered a 30% decline. Equity funds are beginning to see inflows instead of outflows, and bond funds are beginning to suffer outflows. All of these market-based indicators are consistent with a decline in risk aversion which goes hand in hand with a decline in the demand for safe assets. If these trends continue, the Fed will have a clear path—indeed, a mandate—to first taper, then reverse, its Quantitative Easing program.

What follows is a series of charts which track the return of confidence, the decline in the demand for safe assets, and the beginnings of a trend toward taking on more risk. All of these suggest that a tapering of QE is appropriate.

Consumer confidence has been rising irregularly for the past several years, but it is still depressed from an historical perspective. There are still plenty of concerns out there, but they are slowly fading.

U.S. banks have been the recipients of $3 trillion in savings deposit inflows since the onset of the financial crisis in 2008. The growth rate of savings deposits was 10-15% per year from 2009 through last year, but that has now cooled off to a 9% rate. That's still fast, but no longer galloping. The evolution of savings deposits—which pay almost no interest currently—bears close watching. Banks have funneled most of their deposit inflows into bank reserves. A tapering of Fed bond purchases should dovetail nicely with a slowing in the growth of deposit inflows and a lessening of banks' desire to accumulate reserves.

The Vix index measures the implied volatility of equity options, and is thus a proxy for the market's level of uncertainty, fear and doubt. (You pay more for an option when you are uncertain, because owning options limits your downside risk.) Currently, the Vix is close to levels that might be considered "normal." As I interpret this, the market is now relatively confident in the outlook for the U.S. economy; not necessarily excited or optimistic about the outlook, but just reasonably confident that not much is going to change: more slow growth ahead, but much less risk of a another recession. (The Vix has jumped to 14.5 today as the market worries that QE tapering is rapidly approaching.)

Gold has tracked commodity prices pretty well for the past several decades, although it has been much more volatile (note that the scale of the right y-axis is almost twice as large as the one on the left). Gold surged ahead of commodities in 2009, as the world worried about another recession, Eurozone defaults, and the potential for QE to trigger a collapse of the dollar and a surge of inflation. In other words, gold surged as fears and speculation mounted, and as confidence declined. The recent 30% decline in gold prices marks a significant change in this dynamic.

Real yields on 5-yr TIPS have a strong tendency to track the market's expectations for real economic growth. When real yields fell to -1.8%, that was a clear sign that the bond market was very fearful that U.S. economic growth would stagnate, and that another recession was a disturbing possibility. The jump in real yields in recent months is an excellent sign that the market is becoming less pessimistic about the prospects for economic growth, and less anxious to pay a huge premium for the relative safety of short- and intermediate-maturity TIPS.

Gold's decline from the stratospheric heights of $1900/oz. has tracked pretty well with the rise in real yields on TIPS. Both are clear indicators of a decline in the demand for safe assets.

It's probably too early to say that the tide has turned here, but net equity flows in the past seven months have been positive.

The PE ratio of the S&P 500 is about average, having risen from decidedly below-average levels in the past few years. This shows that investors' confidence in the future of corporate profits has improved, although it is still relatively subdued considering that interest rates are still at very low levels from an historical perspective.

Bond funds have seen major outflows in recent months, eclipsing anything seen in the past several years. The demand for the relative safety of bonds has definitely weakened.

The nation's major home builders haven't been this confident about the future of their industry for over 7 years.

U.S. households have been working very hard to reduce their financial burdens and improve the health of their balance sheets (aka deleveraging). As a result, financial burdens (monthly payments relative to disposable income) are as low today as they have been for over 30 years. Risk aversion has been significant in recent years, but it's now possible that households are ready to start taking on more risk.

All things considered, it looks to me like the market is over-reacting to the prospect of a tapering of Fed bond purchases. When it does begin tapering, the Fed will be responding in a responsible fashion to the world's declining demand for safe assets. This is not something to fear, it's something to cheer.

Despite the persistence of doubts and fears, the economy and the financial markets have staged a "reluctant recovery," as I described last November.

The latest source of fear is the approaching tapering and eventual reversal of the Fed's Quantitative Easing. Those who believe that QE has been the essential fuel for our (tepid) recovery and the stock market's rather spectacular gains over the past 4+ years worry that the absence of Fed purchases, followed—at some uncertain point in the future—by the reversal of QE (i.e., the sale by the Fed of the trillions of bonds and MBS it now owns) will surely doom this economy. They reason that the Fed's bond purchases have artificially depressed interest rates, and that this in turn has helped boost the economy—so therefore a reversal of QE will depress the economy.

But as I pointed out in a recent post, "the real point of QE was not to lower bond yields, but to create bank reserves for a world that desperately wanted them." For most of the past four or five years, the world's demand for safe assets has been so strong that there was a relative scarcity of traditional vehicles (the primary one being T-bills). Enter bank reserves, which, thanks to the Fed's decision in 2008 to pay interest on reserves, became functionally equivalent to T-bills, but with a superior yield. In just under five years, banks have accumulated almost $2 trillion of "excess" bank reserves, above and beyond the level required to collateralize their deposits. No one has forced them to accumulate these reserves, and no one has forbade them from using those reserves to massively expand their lending. Yet that is what has happened: the accumulation of reserves for no purpose other than to accumulate safe assets with a positive yield. Clearly, there has been intense demand for bank reserves on the part of banks, arguably because they were functionally equivalent to T-bills, the ultimate safe asset, and because banks were not willing to greatly expand their lending activities—just as the private sector has also been working hard to reduce its debt burdens.

To make a long story short, the Fed's massive QE efforts boil down to a simple transmogrification of Treasury notes, Treasury bonds, and MBS into bank reserves, an exercise that proved necessary to accommodate the world's strong and rising demand for safe assets.

It follows therefore that the "tapering" and the eventual unwinding of QE will be necessary to compensate for the declining demand for safe assets, and not a threat to the financial system. The Fed will stop buying and eventually—in a year or so—start selling bonds as the economic fundamentals improve. When they finally do begin to reverse QE, they will be selling bonds at higher interest rates than we have today (e.g., 10-yr Treasury yields of 4% or so) when the demand for them will be stronger. Indeed, if the Fed does not reduce the supply of bank reserves as the demand for them declines, they will risk igniting what could prove to be a very uncomfortable rise in inflation. That is the risk to worry about—that the Fed fails to reverse to QE in a timely fashion—not the reversal of QE.

The tide of risk-aversion seems to be turning. I have argued before that this process, which includes the return of confidence (lack of confidence breeds demand for safe assets, so the return of confidence should go hand in hand with a decline in the demand for safe assets), is already underway, though still in its early stages.

What follows is a series of charts which track the return of confidence, the decline in the demand for safe assets, and the beginnings of a trend toward taking on more risk. All of these suggest that a tapering of QE is appropriate.

Consumer confidence has been rising irregularly for the past several years, but it is still depressed from an historical perspective. There are still plenty of concerns out there, but they are slowly fading.

U.S. banks have been the recipients of $3 trillion in savings deposit inflows since the onset of the financial crisis in 2008. The growth rate of savings deposits was 10-15% per year from 2009 through last year, but that has now cooled off to a 9% rate. That's still fast, but no longer galloping. The evolution of savings deposits—which pay almost no interest currently—bears close watching. Banks have funneled most of their deposit inflows into bank reserves. A tapering of Fed bond purchases should dovetail nicely with a slowing in the growth of deposit inflows and a lessening of banks' desire to accumulate reserves.

The Vix index measures the implied volatility of equity options, and is thus a proxy for the market's level of uncertainty, fear and doubt. (You pay more for an option when you are uncertain, because owning options limits your downside risk.) Currently, the Vix is close to levels that might be considered "normal." As I interpret this, the market is now relatively confident in the outlook for the U.S. economy; not necessarily excited or optimistic about the outlook, but just reasonably confident that not much is going to change: more slow growth ahead, but much less risk of a another recession. (The Vix has jumped to 14.5 today as the market worries that QE tapering is rapidly approaching.)

Gold has tracked commodity prices pretty well for the past several decades, although it has been much more volatile (note that the scale of the right y-axis is almost twice as large as the one on the left). Gold surged ahead of commodities in 2009, as the world worried about another recession, Eurozone defaults, and the potential for QE to trigger a collapse of the dollar and a surge of inflation. In other words, gold surged as fears and speculation mounted, and as confidence declined. The recent 30% decline in gold prices marks a significant change in this dynamic.

Real yields on 5-yr TIPS have a strong tendency to track the market's expectations for real economic growth. When real yields fell to -1.8%, that was a clear sign that the bond market was very fearful that U.S. economic growth would stagnate, and that another recession was a disturbing possibility. The jump in real yields in recent months is an excellent sign that the market is becoming less pessimistic about the prospects for economic growth, and less anxious to pay a huge premium for the relative safety of short- and intermediate-maturity TIPS.

Gold's decline from the stratospheric heights of $1900/oz. has tracked pretty well with the rise in real yields on TIPS. Both are clear indicators of a decline in the demand for safe assets.

It's probably too early to say that the tide has turned here, but net equity flows in the past seven months have been positive.

The PE ratio of the S&P 500 is about average, having risen from decidedly below-average levels in the past few years. This shows that investors' confidence in the future of corporate profits has improved, although it is still relatively subdued considering that interest rates are still at very low levels from an historical perspective.

Bond funds have seen major outflows in recent months, eclipsing anything seen in the past several years. The demand for the relative safety of bonds has definitely weakened.

The nation's major home builders haven't been this confident about the future of their industry for over 7 years.

U.S. households have been working very hard to reduce their financial burdens and improve the health of their balance sheets (aka deleveraging). As a result, financial burdens (monthly payments relative to disposable income) are as low today as they have been for over 30 years. Risk aversion has been significant in recent years, but it's now possible that households are ready to start taking on more risk.

All things considered, it looks to me like the market is over-reacting to the prospect of a tapering of Fed bond purchases. When it does begin tapering, the Fed will be responding in a responsible fashion to the world's declining demand for safe assets. This is not something to fear, it's something to cheer.

Subscribe to:

Posts (Atom)